Position sizing should be part of your overall investment strategy regardless of what style of investing you use. It is intended to control downside risk. There are certain rules you should follow but like most things with stock investing you do have to customize the process to fit your personal needs and risk profile..

How much you buy in a single trade—or your position size—is a critical decision. It directly impacts how much you might gain or lose on a trade and is another key part of the risk equation. Position size is influenced by two important concepts: portfolio risk and total amount invested.

Portfolio risk is the target maximum amount of money you’d lose on a single trade if the trade hit your stop, or was “stopped out.” Most investors with a “Low” appetite for risk should settle in on .5%, moderate risk 1% and aggressive should keep it 2% or less. If you are just getting started with investing I’d recommend the 1/2 percent level until you get familiar with how the sizing works and impacts your overall portfolio.

Investors also need to consider the total amount invested in any one trade. Consider setting a guideline to allocate no more than 10% of your portfolio to one investment. You may want to scale down if you’re more conservative or new to investing.

To figure this all out you need to determine the Trade Risk of the stock you are ready to purchase. Trade risk is the stocks purchase price minus the stop price.

Stop Price has no right or wrong answer when calculating. It is your decision to make at the time of the purchase when you get out of a stock that is turning against you. One good method is to look at current support levels on the chart and set a stop price. (Low risk appetite set just below support, average risk about 3% below that and more aggressive set about 5% below support.

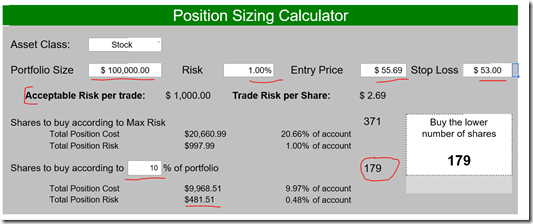

Here’s an example of a stock XYZ selling for 55.69.

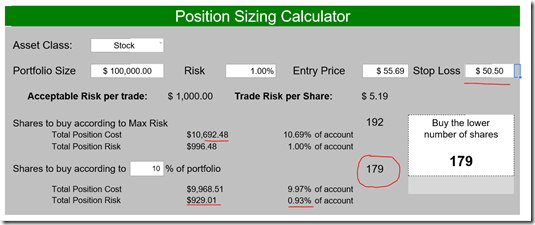

Some might see support at 53 while others may call support at 50.50. Neither is wrong and will end up carrying the same risk in dollars. The trade risk on the 53 stop is 55.69-53=2.69 while the trade risk on the 50.50 stop is 55.69-50.50=5.19

In the below example, notice that the acceptable risk per transaction is 1000 dollars so with the tighter stop you can purchase 371 shares but need to get out if stock goes down to 53. Also notice that since you don’t want to exceed 10 percent of the portfolio you need to reduce your purchase from 371 down to 179 to stay under 10,000 dollars. This also reduces your risk exposure down to 481 dollars if you have to exit at 53.

Higher trade risk below equals less shares per max risk (192 vs 371 above) but shares to actually buy remains the same at 179 due to 10% allocation rule.

Lastly, Here is a google spreadsheet for you to use to make your own calculations if you decide you like this concept and want to incorporate it into your trading rules.

Google Sheets Position Sizing Calculator

I did put edit rights on this share but if you plan to use it you should save a copy of it to your google sheets for your personal use.