Paper trading can be very educational in learning different trading strategies without costing expensive lessons using real money. One downside to paper trading is that you are able to trade without emotion since you are not risking real money so a system that works for you in paper money will not work in real money unless you use the same emotional framework you used in paper money.

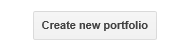

Let's get started. Go to https://www.google.com/finance and click on Portfolios on the left sidebar menu and then look for a button

Give a descriptive name as you can create as many of these as you want. I like to have one for Growth, Value, Income and Penny stocks.

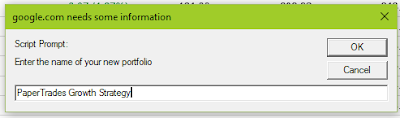

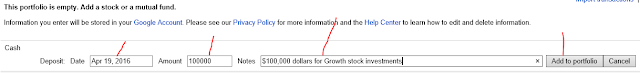

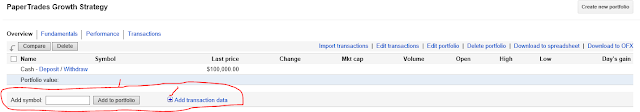

Once you name the portfolio you get the below screen. Click the "Deposit" to fund with your play money.

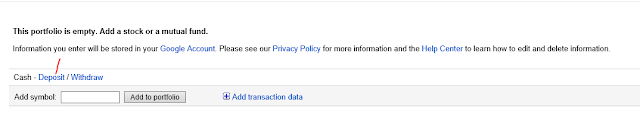

I just do 100,000 for each portfolio but here is your chance to be a pretend multi-millionaire if you want.

Once you click "Add to portfolio" shown in screen shot above, you will get the screen shown below. From here, you can manually add symbols or bring up a stock summary in Google Finance to add stocks to your portfolio.

To add manually put the symbol you want in the box and click the + sign Add transaction data. Or, from stock summary screen below click Add to portfolio

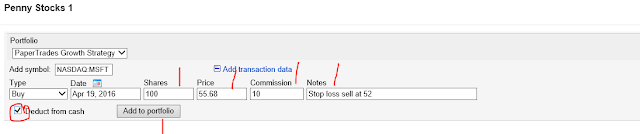

Fill in the information in the transaction section asked for in the screen shot below. It is not necessary to add a commision but I like to do so as it gets calculated in actual gain/loss and helps me account for them when I trade real money. Important, don't forget to check the box for "Deduct from cash" Since you can't automatically enter stop orders you should make a note as to where you would stop out if stock drops and if it happens, click the "Add transaction" and enter in a sell order.

Check "Deduct from cash"

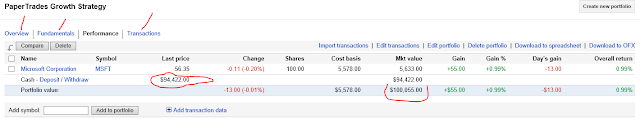

There you go, your very own Paper Money trading platform. Hope you enjoy it.

This only deals with creating the paper money portfolio and may leave many new investors with a lot of questions on what should I buy, how many shares should I buy, when should I buy or when should I sell. All great questions that you should continue to learn about.