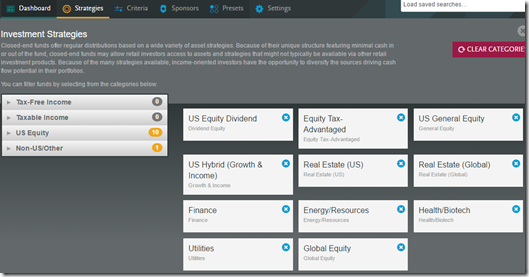

After reviewing the articles I’ve posted over the past few days on what makes up a good CEF and things to watch for, it’s time to put it to work. A good free resource for closed end funds is at http://cefconnect.com which has a very good fund screener along with extensive research information on each fund. So first I have to start with a screen. For this particular screen I’m going to focus on equity CEF’s and not bonds. My personal reasons for this is that I am most familiar with stocks and my knowledge of the bond market is not great so I choose not to learn about them at this time.

Screen info:

I selected equity type funds and also included specific sector focus to help add to diversification.

Above is the criteria I am screening for. I want to limit the exposure of leverage to those funds with 30% or less leverage. My distribution rate is set to range from 5% to 9%. I don’t want less then 5% to get the most return for the amount invested to be worth the risk. But, over 9% is chasing yield and most anything that pays out 10% or higher is doing so because something is wrong and typically they can not sustain such high payouts. They are not worth the risk. I selected monthly on my Distribution Frequency as a matter of personal taste. I already have several stocks in my dividend portion that pay quarterly and I’d like to have some monthly income flowing in. I selected under 0 for Discount / Premium as I do not want to pay more than 1.00 per 1.00 of assets. I was not able to get the Z-Score into the screen shot but I did select a 1 year Z-Score of all under 0 to confirm that fundamentally the relative discount is a value at the current levels.

At the bottom of the screener a tally of the number of stocks is kept and changes on each selection you make. This one got down to 9 funds based on my criteria. Clicking on “View Funds” button will bring up the results.

So above is the 9 funds that pass the criteria I set in the screen. Am I don yet? No, not even close. Next I will research each of the 9 funds. I will look at several years of NAV discount/premium history and confirm that NAV is at least the same or not significantly lower than around 5 years ago. I’ll also look at 5 years of distribution history for consistency in payments and most importantly how the distributions are being paid, watching out for use of return on capital. Then I’ll look at the charts to see how the technical’s look for entry.

Once I narrow that down to the 2 or 3 postions I am thinking of taking on, I’ll have to position size based on my earlier post about that topic and then take the plunge.

One point I want to make here is that this list of 9 funds are not a buy list and no one should act on these without doing their own due diligence.

No comments:

Post a Comment