The idea behind top down investing is that in the S&P 500 it is divided into sectors and within each sector is a number of industries. As the economy moves through it’s different cycles between expansion and contraction, certain industries become more attractive than others and they tend to attract more investors (more money flowing) into them. This tends to make that sector outperform the S&P benchmark while those sectors out of favor will underperform the benchmark.

The screen shot above is from my think or swim platform that allows me to look at the sectors by performance compared to SPY (S&P benchmark) Notice the columns on the right. This one is sorted by 10 day performance and shows currently (mid July 2016) that Biotech (an industry) is out performing the SPY by about 3% in the past 10 trading days while Utilities (sector) is underperforming SPY by around 2%. I use 10 day performance for short term trend trades and 3 month for intermediate term trends

The concept I learned is the saying that “a rising tide floats all boats” which means that most stocks within an outperforming industry will outperform the S&P. This is usually indicated on the charts by an uptrend. The length of the uptrend to look at depends on the type of investing you are doing. If you are a short term investor the uptrend does not have to be months long. If you are an intermediate term investor you want the uptrend to at least show a small rise in the 30 day moving average and pointing up. It’s not an exact science and this method is only intended to give an investor an “edge” in picking up trending stocks.

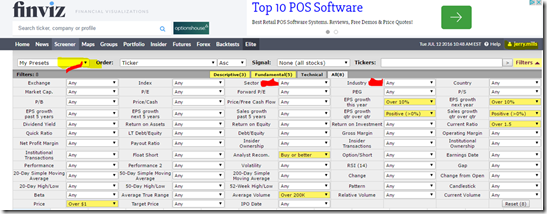

So, with that in mind, in order to find stocks that meet top down style we can run a screen. FinViz at http://finviz.com has a pretty decent free screener. See the screen shot below.

You do not need to register with them to run screens but do need to register to save them. It is free to register and is well worth the time to do so. To save a screen after you have set it up, just click the down arrow in “My Presets” (upper left corner) and give it a name. You can adjust this screen to suit yourself but the ones I use are highlighted in yellow. I like a stock to be over $1 in price with an analyst recommendation of buy or better. I also like average volume over 200,000 to insure I can get in and out of a trade quickly. In order for a growth stock to grow, earnings need to be improving so I look for those that grew earnings by at least 10% this year and projected earnings growth of 10% next year. Additional test on earnings is improving earnings and sales quarter to quarter. I like to add the current ratio of over 1.5 because I like to know that a company can cover it’s current liabilities with it’s current assets. I save this screen setup with the name of “TopDownInvesting(addSector)”

With this criteria mentioned above, today I am getting 172 results. But, I’m looking for strong sectors or industries. So I need to add a criteria in one or both of the items marked in red in the above screenshot. Materials is one of the strong sectors over the past 10 days so by changing the sector to Basic Materials (screenshot below) I get 7 results.

I can easily switch from one sector to the next to get the stronger stocks in any particular industry. Adjusting any of the criteria up or down will of course change the number of results. For example, if I changed Current Ratio to “Any” I would get 13 results. Any screener you use though is just that. It’s a screener. It does not say “buy me”. You must look at and evaluate each stock before making a decision.

No comments:

Post a Comment