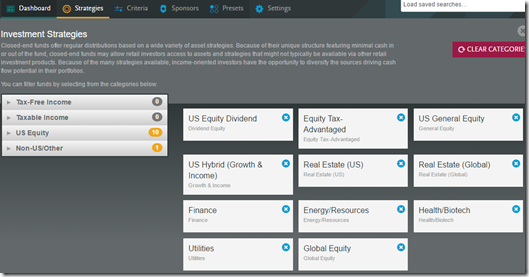

(information from Morningstar.com’s CEF section)

CEFs have an underlying portfolio of securities. From this portfolio, a net asset value (NAV) can be derived.

NAV = (assets – liabilities) / shares outstanding

the investment portfolio primarily, if not solely, comprises the assets. For leveraged CEFs, the leverage itself is the bulk of the liabilities.

CEFs trade on an exchange. This means that they have a share price, which is set by the market. These two prices, the NAV and the share price, are rarely the same, and when they are, it's only by coincidence.

The differences between the share price and the NAV create discounts and premiums. Shares are said to trade at a "discount" when the share price is lower than the NAV. The discount is commonly denoted with a minus ("-") sign. Shares are said to trade at a "premium" when the share price is higher than the NAV. The premium is commonly denoted with a plus ("+") sign. The calculation is (Share price ÷ NAV) – 1. Examples:

Share price = $19.00

NAV = $20.00

Discount = ($19.00 ÷ $20.00) – 1 = 0.95 – 1 = -0.05 = -5.0%

Share price = $12.00

NAV = $10.00

Premium = ($12.00 ÷ $10.00) – 1 = 1.20 – 1 = +0.20 = +20.0%

What gives rise to discounts and premiums? Why is the market seemingly inefficient?

Efficient market hypothesists have tried to explain discounts and premiums for years with myriad explanations. Most commonly, the reason a CEF trades at any given discount or premium is related to the fund's distribution rate, regardless of the source of the distribution. (Some fund families seemingly abuse the knowledge that this occurs to justify--in their minds, not ours--the use of destructive return of capital.)

Other typical reasons for premiums and discounts include:

- Overall market volatility

- Recent NAV and share price performance

- Brand recognition of fund family

- Name recognition (or lack thereof) of the fund manager

- Recent changes in distribution policy

- An asset class or investment strategy falling out of market favor

- An asset class or investment strategy rising in the market's esteem

Whatever the reason for a CEF's discount or premium pricing, it is crucial that CEF investors realize that discounts and premiums exist.

At Morningstar, when comparing a share price with a NAV, we often refer to discounts and premiums as "Absolute Discounts" and "Absolute Premiums."

We do this because, as discussed in another Solution Center presentation, there are other ways to look at discounts and premiums. For instance, if we compare a CEF's discount to its average historic discount, this is what we refer to as a "Relative Discount."

Most long-term investors just look at Absolute Discounts and Absolute Premiums. But when considering valuation, it's important to look at Relative Discounts and Relative Premiums.

There are three things to consider regarding discounts and premiums:

- Regardless of the discount or premium, what matters to an investor is the share price at the time of purchase and the subsequent total return of the CEF.

- A CEF's discount or premium tends to persist. If the CEF typically trades at a large discount, it will tend to stay at a large discount, barring any corporate actions from the board of directors. The same can be said of premiums. Even in periods of extreme market volatility, CEFs that typically trade far below or far above the universe's average discount will more than likely continue to trade that way, even if during the downturn the premium turns to a discount.

- Over a complete market cycle, most CEF share prices will trade below, at, and above their corresponding NAVs.

Absolute Discounts

The standard thinking for CEFs is to focus on funds trading at discounts and to avoid funds trading at premiums. We think this maxim is simplistic and could lead to unrealistic expectations for investors.

All that matters for a CEF investor is the share price at which the CEF was purchased and the subsequent total return. Discounts and premiums wax and wane over time. For instance, if a CEF is trading at a 15% discount, people often tout this as an opportunity to buy $1.00 of assets for $0.85. The unstated premise is that eventually the price will reach $1.00.

This is problematic. Nothing mandates that a share price, even discounted at 15% to NAV, must converge to its NAV over time. Furthermore, the NAV could decline to $0.85 (or lower).

We recommend not purchasing CEFs at absolute discounts in the hope that the share price will converge to a higher NAV. The primary benefit of purchasing a CEF at an absolute discount is for income-seeking investors to enhance their yield.

"Yield Enhancement" and Absolute Discounts

Putting aside sources of distribution, let's assume that a fund's underlying portfolio at NAV yields 10%.

Distribution = $1.00 per share

Net Asset Value = $10.00 per share

Distribution Rate at Net Asset Value = $1.00 / $10.00 = 10%.

Let's further assume that the shares trade at a 10% absolute discount.

Net Asset Value = $10.00 per share

Share Price = $9.00 per share

Absolute Discount = (share price – NAV)/NAV = ($9 - $10) / $10 = -10%

Because they are buying at a discount, investors purchasing these shares will get a higher yield:

Distribution = $1.00 per share

Share Price = $9.00 per share

Distribution Rate at Share Price = $1.00 / $9.00 = 11.1%

So, "Yield Enhancement" = Dist Rate (Share Price) / Dist Rate (NAV) = 11.1% / 10% = 1.1%

Buying $1.00 of assets for $0.85 isn't necessarily a bargain.

The table below sets forth the nine scenarios that can play out when purchasing shares at an absolute discount.

How the Absolute Discount Can Narrow

- NAV falls faster than the share price: This is the worst possible scenario. The underlying portfolio is losing value and your shares are worth less.

- NAV falls and share price remains steady: This is the second-worst scenario, in that the underlying portfolio is losing value. At least your shares haven't declined in value.

- NAV falls and share price rises: The investment portfolio is heading south but at least you are making some money. Be careful, though, because ultimately the discount or premium will rely, at least in part, on the portfolio's performance.

- NAV is steady and share price rises: This is the scenario implied by investors who say they buy $1.00 for $0.85.

- NAV rises and share price rises even faster: This is the best of all possible scenarios. Of the nine scenarios, this occurs in only half of one (because the NAV could rise faster than an increasing share price, meaning the discount would widen).

Also note the several scenarios where the share price declines or the absolute discount widens. Using absolute discounts as the sole method of finding undervalued CEFs is akin to investing in a value trap.

On the flip side, there is no reason to avoid all CEFs trading at an absolute premium.

If you are purchasing shares at an absolute premium, you are taking on risk. Your capital could decline, even if the underlying portfolio performs well.

This isn't to say you should never invest at a premium. Most CEF investors have no qualms investing at slight premiums to NAV. But absolute premiums above 10% should really give you pause.

The table below shows the nine scenarios that can play out when purchasing shares at an absolute premium.

If you find yourself in a situation where the share price is rising and the NAV is declining, you are likely in what Warren Buffett might call a "greater fool" scenario. You may want to consider taking your profits and finding a more suitable investment.

Note that only one half of one scenario leads to a rising share price and a narrowing premium.

Unwittingly purchasing shares at an absolute premium, only to see the share price decline as the premium narrows, is the number one reason people have a poor experience with CEF investing.

Key Takeaways

- Every CEF has a discount or a premium. It is rare, and short-lived, for a share price to equal the net asset value.

- Absolute discounts are an inappropriate method of finding undervalued CEFs. When searching for undervalued CEFs, use relative discounts

- Absolute discounts can and should be sought for "yield enhancement." Make sure to see our Solution Center presentation on distributions.

- Absolute premiums should not preclude investment, but they do represent additional investment risk. Extreme premiums above 10% should really give investors pause. Unless the NAV rises to meet your purchase price, even in the long run you will likely lose money on your investment.

- While there is nothing that mandates a CEF share price equal its net asset value, history shows that funds normally trade at both an absolute discount and an absolute premium over the course of a full market cycle. In other words, the share price does tend to revert toward, and then through, the NAV.

- Again, when investing in CEFs, discounts and premiums don't ultimately matter. What matters is your cost basis and the subsequent total return.